Table of Contents

FEDNOW and Bitcoin: Why Real-Time Payments Need Lightning API Integration for Maximum Reach

Comet Cash Team

•

Dec 9, 2025

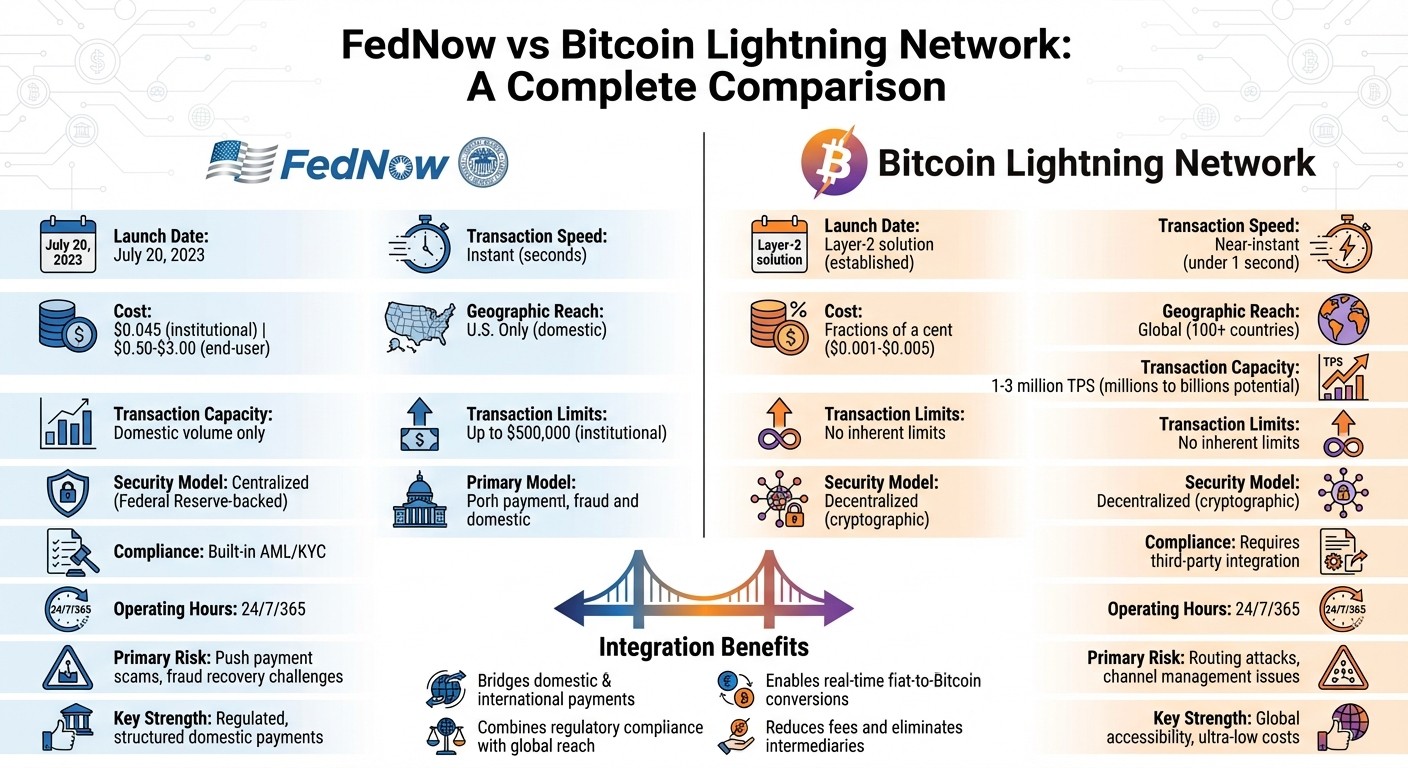

FedNow, launched in 2023, enables instant payments across the U.S., operating 24/7/365 and settling transactions in seconds. However, it lacks support for international payments. The Bitcoin Lightning Network, a Layer-2 solution for Bitcoin, excels at fast, low-cost cross-border transactions but faces challenges with regulatory compliance and integration into traditional banking systems.

Combining FedNow's domestic infrastructure with the Lightning Network's global reach could create a unified payment system. FedNow offers structured, regulated payments, while Lightning provides scalability and affordability for international transfers. Together, they could simplify cross-border payments, reduce fees, and enable real-time fiat-to-Bitcoin conversions.

Key Points:

FedNow: U.S.-only, instant payments, $0.045 per transfer, $500,000 limit.

Lightning Network: Global, near-instant, fractions of a cent per transaction, no set limits.

Quick Comparison:

Feature | FedNow | Bitcoin Lightning Network |

|---|---|---|

Transaction Speed | Instant | Near-instant |

Cost per Transaction | ~$0.045 (institutional) | Fractions of a cent |

Geographic Reach | U.S. only | Global |

Security Model | Centralized | Decentralized |

Transaction Limits | Up to $500,000 | No inherent limits |

Integrating these systems could address each other's weaknesses, streamlining both domestic and international payments.

FedNow vs Bitcoin Lightning Network: Complete Payment System Comparison

Lightning The Future of Payments with Bitcoin’s Layer 2 Solutions

1. FedNow

FedNow officially launched on July 20, 2023, offering a public infrastructure for instant payments across the United States. Unlike traditional ACH transfers, which can take 1–3 business days to process, FedNow settles transactions individually within seconds, ensuring funds are immediately available to recipients.

The service operates around the clock - 24 hours a day, 7 days a week, 365 days a year. This means payments clear just as quickly on weekends and holidays as they do on regular weekdays. Transactions are final, reducing the risk of reversals, and both parties receive instant confirmation of the payment. FedNow also adopts the ISO 20022 messaging standard, which allows for richer transaction data, such as invoice details, to accompany payments.

Financial institutions with a Master Account at the Federal Reserve can access FedNow. Its pricing structure is designed to be accessible, especially for smaller regional banks. Costs include a $25 monthly participation fee per routing transit number, $0.045 per credit transfer (paid by the sender), and $0.01 for each Request for Payment message.

The system supports transactions up to $10 million per credit transfer, with no limit on the number of transactions. Additionally, FedNow offers APIs for a range of functions, including payment initiation, status tracking, account validation, and reporting. Tim Rozanski from Pidgin highlights the importance of these APIs:

"We see APIs as the catalysts for building scalable instant payment solutions that facilitate secure connections for data transmission, allowing financial institutions to take advantage of the FedNow Service's vast potential".

Despite its robust framework, FedNow is strictly limited to domestic transactions in U.S. dollars. While it offers a comprehensive solution for instant payments within the country, its inability to process cross-border payments could present challenges for businesses with international operations as adoption grows nationwide.

2. Bitcoin Lightning Network

The Bitcoin Lightning Network is a Layer-2 solution built on top of the Bitcoin blockchain. Its main goal? Solve Bitcoin's challenges with speed, scalability, and transaction costs. While Bitcoin's base layer can handle around 7 transactions per second, the Lightning Network significantly boosts this capacity to between 1 and 3 million transactions per second.

The system works by moving transactions off-chain through bidirectional payment channels. This approach enables payments to settle in under a second, making it ideal for everyday purchases and even small-scale transactions. Plus, the fees are incredibly low - ranging from just $0.001 to $0.005 - compared to Bitcoin's on-chain fees, which can soar past $30 during high network activity.

Another major advantage is its ability to handle cross-border payments without involving intermediaries. This feature is a game-changer for international transactions. Businesses can send payments instantly across borders, avoiding the long delays and hefty fees typical of traditional banking systems. The network's reach extends to over 100 countries, providing a much-needed financial lifeline to underbanked regions where conventional banking infrastructure is either inaccessible or too costly.

Unlike FedNow, which operates solely within the United States, the Lightning Network supports global transactions using Bitcoin. Its decentralized structure ensures that anyone with internet access can participate. Additionally, its open framework allows developers to integrate Lightning APIs into existing payment platforms, enabling programmable and instant settlements. These features make the system a strong contender for addressing the challenges of integrating with traditional payment systems.

However, linking the Lightning Network with established financial systems comes with its own set of hurdles. Compliance with regulations like AML, KYC, and IRS reporting is essential. Security is another critical area, with measures needed to counter risks such as routing attacks, channel jamming, and liquidity shortages. On top of that, the system must operate continuously and process transactions in real time to meet the high standards of institutional payments.

Strengths and Weaknesses

Examining the strengths and weaknesses of FedNow and the Bitcoin Lightning Network reveals how their integration could create a more comprehensive payment system. FedNow, developed by the Federal Reserve, caters to large-scale U.S. transactions. It offers strong fraud prevention, strict AML/KYC compliance, and a "good-funds" model, which minimizes counterparty risk. With transaction limits of up to $500,000 for institutions, it’s well-suited for handling significant domestic transfers. On the other hand, the Bitcoin Lightning Network shines with its speed and international scope.

The Bitcoin Lightning Network is designed for global accessibility and cost efficiency, enabling near-instant and extremely low-cost transactions. While FedNow transactions cost approximately $0.045 for institutions and $0.50–$3.00 for end-users, the Lightning Network charges only fractions of a cent. This makes it ideal for micropayments and affordable cross-border transfers. Furthermore, its ability to process millions to billions of transactions per second far surpasses the capacity of domestic payment systems like FedNow.

When it comes to security, both systems take different approaches. FedNow relies on centralized oversight and ISO 20022 compliance standards, while the Bitcoin Lightning Network employs decentralized cryptographic security, featuring self-custodial wallets and watchtowers. Both systems ensure payment finality through irrevocable transactions, which, while secure, complicate error correction and fraud recovery. These contrasting security models highlight how the two systems could complement each other when combined.

Each system also has its limitations. FedNow is restricted to domestic transactions and is less efficient for low-value payments due to its higher fees. Meanwhile, the Bitcoin Lightning Network is more vulnerable to technical risks, such as routing attacks and channel management issues, compared to FedNow's centralized safeguards. Users of the Lightning Network must actively monitor their channels to maintain security.

Feature | FedNow | Bitcoin Lightning Network |

|---|---|---|

Transaction Speed | Instant, real-time settlement | Near-instant transactions |

Cost per Transaction | ~$0.045 (institutional), $0.50–$3.00 (end-user) | Fractions of a cent |

Geographic Reach | U.S. domestic only | Global |

Transaction Capacity | Limited to domestic volume | Millions to billions per second |

Security Model | Centralized, Federal Reserve–backed | Decentralized, cryptographic |

Regulatory Compliance | Built-in AML/KYC via banking systems | Requires third-party integration |

Transaction Limits | Up to $500,000 for institutions | No inherent limits |

Primary Risk | Push payment scams; fraud recovery challenges | Routing attacks; channel management |

Conclusion

FedNow's regulated, always-on domestic instant payments and the Lightning Network's global, low-cost transactions create a dynamic pairing that addresses the weaknesses of each system. FedNow provides a structured framework with ISO 20022 compliance, while the Lightning Network brings global accessibility and the capacity to process massive transaction volumes.

Together, this integration bridges domestic and international payments by removing intermediaries, cutting down fees, and eliminating settlement delays. The Lightning Network gains the advantage of seamless fiat conversion and regulatory alignment through FedNow's established banking infrastructure. This collaboration paves the way for real-time blockchain payments with final bank settlements, automated smart contracts, and programmable compliance features.

FAQs

How can integrating FedNow with the Bitcoin Lightning Network improve cross-border payments?

Integrating FedNow with the Bitcoin Lightning Network has the potential to transform cross-border payments by allowing quicker and more affordable transactions. The Lightning Network's infrastructure is built for instant, low-cost payments, addressing the common issues of delays and steep fees tied to international money transfers.

This combination could also play a role in expanding access to financial services, particularly for underserved communities. By leveraging the Lightning Network's capacity to handle large volumes of transactions efficiently, FedNow could extend its capabilities on a global scale, enabling smooth and reliable payment processing for businesses and individuals alike.

What regulatory challenges could arise from integrating the Lightning Network with FedNow?

Combining the Bitcoin Lightning Network with FedNow could encounter regulatory challenges, particularly around anti-money laundering (AML) and know-your-customer (KYC) compliance. Balancing the need for fast, efficient transactions with strict regulatory standards is no small feat and adds layers of complexity to the process.

On top of that, differences in cryptocurrency regulations across jurisdictions and the potential friction between decentralized systems and a federally managed payment network introduce additional hurdles. Successfully navigating these issues will demand clear regulatory guidance and close cooperation between industry players and regulators to ensure the integration is both secure and compliant.

What makes the Lightning Network's decentralized model ideal for global payments?

The Lightning Network operates on a decentralized framework, making it a game-changer for global payments. By allowing users to transact directly, it removes the need for traditional banking systems. All that's required is an internet connection, opening up access to people worldwide, including those in areas with limited financial services.

This system supports instant, low-cost transactions across borders, eliminating the usual delays and hefty fees tied to traditional payment methods. Its ability to handle transactions efficiently and at scale positions it as a key player in promoting financial access and enabling seamless global trade.