Table of Contents

Why Bitcoin Payments makes Sense For Global Service Providers

Comet Cash Team

•

Dec 16, 2025

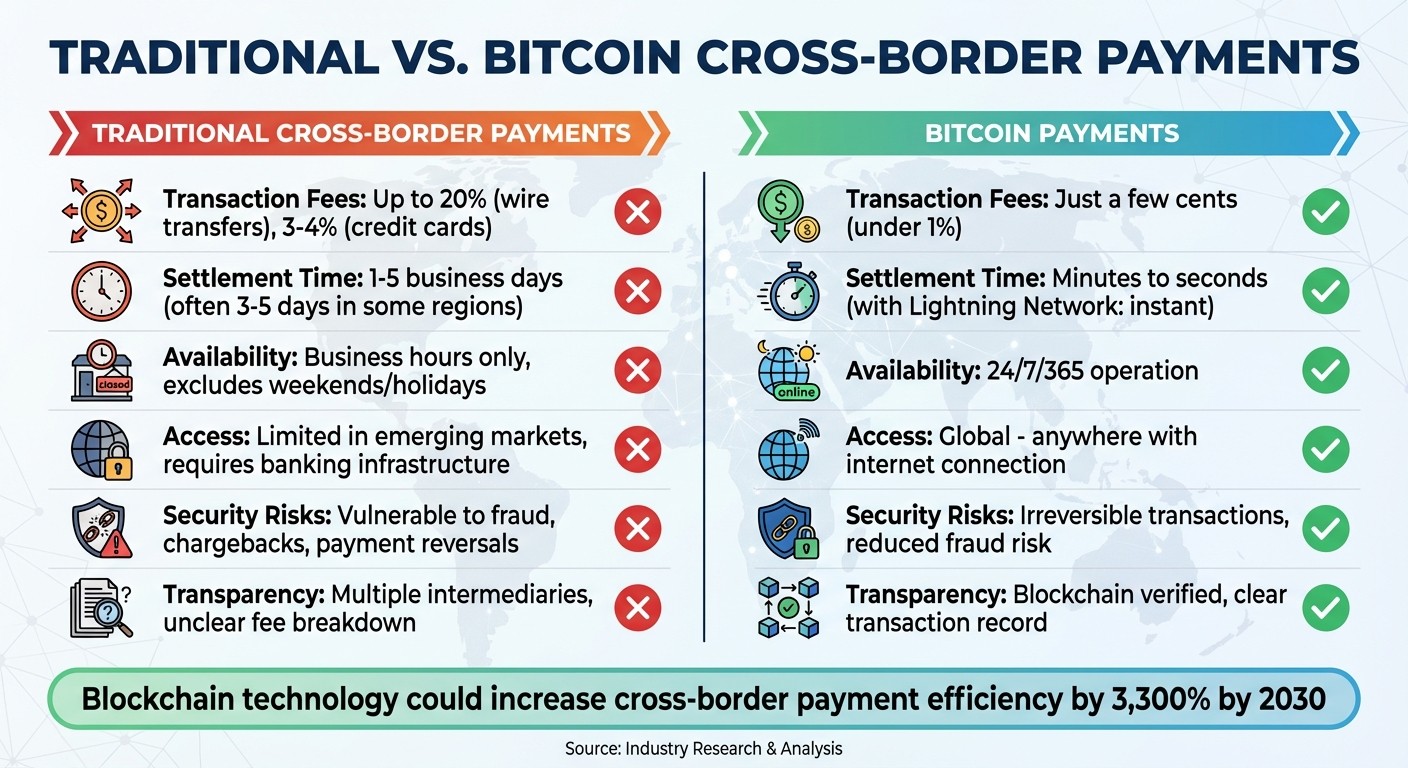

Handling payments across borders is expensive, slow, and often inaccessible for many businesses and customers. Traditional methods like wire transfers and credit cards come with high fees (up to 20% for wires, 3-4% for cards), long delays (1-5 business days), and added risks like fraud and chargebacks. These challenges make it harder for businesses to operate efficiently, especially in regions with limited banking infrastructure.

Bitcoin offers a better solution:

Lower fees: Bitcoin transactions cost just a few cents, compared to traditional fees of up to 4%.

Faster payments: Settlements happen in minutes, even on weekends or holidays.

Global access: Payments can be made anywhere with an internet connection, bypassing banking restrictions.

Security: Transactions are irreversible, reducing fraud and chargeback risks.

With tools like the Lightning Network, which enables instant payments with almost zero fees, Bitcoin is transforming how businesses handle cross-border payments. Platforms like Comet Cash simplify integration, making it easier for companies to accept Bitcoin and benefit from its efficiency.

To get started, businesses should ensure compliance with regulations, manage Bitcoin’s price volatility, and secure their funds. For those ready to embrace this payment method, Bitcoin provides a faster, cheaper, and more accessible way to handle global transactions.

Traditional Payments vs Bitcoin: Cost, Speed, and Accessibility Comparison

Problems with Traditional Cross-Border Payments

High Transaction Costs and Fees

Sending money internationally often involves a web of intermediaries - each adding their own fees and currency conversion markups. As Thunes explains:

Cross-border payments pass through multiple correspondent banks, financial institutions and third-party payment providers, each of which can add extra fees to the payment cost. Fluctuating currency conversions can also add unexpected costs to every transaction.

Take PayPal, for example, which charges nearly 4% per transaction. Wire transfers can be even worse, with fees climbing to as much as 20% of the amount sent . To put it in perspective, a U.S. software company invoicing $50,000 to a client in Brazil could lose over $2,000 in fees alone.

Slow Settlement Times

Traditional cross-border payments, like bank wires or SWIFT transfers, are far from instant. Settlement can take anywhere from 1 to 5 business days . In some regions, delays frequently stretch to 3–5 business days, creating cash flow challenges. Add weekends and holidays into the mix, and the wait can feel endless. Finance teams are often forced to pre-fund accounts or endure delays to access funds . As BitPay puts it:

Cross-border B2B payments are typically handled by bank wires, which (in the age of the Internet) are very slow, costly, and unnecessarily complicated.

Fraud, Chargebacks, and Payment Reversals

Traditional payment systems come with their own set of risks. They’re vulnerable to fraud, including identity theft and cyberattacks, as the multiple touchpoints in correspondent banking networks increase exposure . On top of that, payments can be reversed through chargebacks, adding financial and operational headaches. Unlike Bitcoin transactions, which are irreversible, these reversals disrupt cash flow and require additional resources to resolve disputes.

Limited Access in Emerging Markets

In many emerging markets, banking infrastructure is either inefficient or outright unavailable . For U.S. businesses looking to expand into regions like Africa, Southeast Asia, or Latin America, country-specific financial restrictions can make transactions difficult - or even impossible - limiting their ability to reach new customers.

Operational Overhead and Complexity

Handling international payments isn’t just costly - it’s a logistical nightmare. Businesses must navigate a maze of regulations across different jurisdictions, including AML, KYC, and compliance with sanctions like OFAC . The IMF highlights the inefficiencies:

International payments mostly travel through networks of commercial banks that have accounts with each other, known as correspondent banking. The use of multiple data formats, long process chains, and payment systems with different operating hours results in high costs, delays and less transparency.

BitPay offers a vivid example of the frustration:

To check the status of a payment, the receiver logs into their bank and sees a transaction 'INCOMING WIRE' with an amount that is nearly always less than what was expected. The bank offers little to no explanation regarding the path and fees that occurred along the way.

Finance teams often spend hours chasing down discrepancies or locating missing funds. These inefficiencies highlight the need for a more streamlined approach, paving the way for Bitcoin payments to simplify global transactions.

For eCommerce Experts Who Want to Revolutionise Cross-Border Payments with Crypto

How Bitcoin Payments Solve Cross-Border Payment Problems

Bitcoin tackles the common hurdles of cross-border payments head-on: high fees, slow processing times, and risks of fraud. By enabling direct, decentralized transactions, Bitcoin eliminates the need for traditional intermediaries.

Lower Transaction Costs

One of Bitcoin's standout features is its low transaction fees, often just a few cents. Compare that to traditional payment systems, which can charge fees of up to 4% per transaction. Some Bitcoin exchanges, on the other hand, keep fees under 1%. Studies show that adopting blockchain technology for cross-border payments could lead to massive cost savings - potentially increasing efficiency by as much as 3,300% by 2030. These savings align perfectly with Bitcoin's ability to process payments quickly.

Fast and Real-Time Settlement

Bitcoin operates around the clock, offering continuous settlement. With the Lightning Network, transactions can be completed almost instantly. Unlike traditional wire transfers that can take several business days to clear, Bitcoin payments are processed in minutes or even seconds. Deloitte highlights this advantage:

"Using crypto as a form of payment could reduce transaction fees and possibly eliminate the cost of float and the need to wait multiple days for cash settlement".

Final Settlement and Reduced Chargeback Risk

Bitcoin's transactions are irreversible, which means no chargebacks. This feature ensures predictable cash flow and minimizes the costs associated with disputes - a crucial benefit for businesses handling high-value B2B transactions.

Borderless and Global Access

Because Bitcoin is internet-based, it works anywhere with an internet connection. This eliminates many of the barriers tied to traditional banking systems, particularly in regions with limited financial infrastructure. For instance, in February 2025, a UK tech startup paid a freelance developer in Argentina instantly. At the same time, a remote worker in the Philippines avoided the delays of international wire transfers by receiving payment directly into their Bitcoin wallet.

The International Monetary Fund (IMF) underscores this capability:

"Being a single source of information, blockchains can greatly simplify the processes linked with cross-border payments and reduce costs".

Transparency and Security

Bitcoin's blockchain ensures every transaction is transparent and verifiable. Anyone can confirm that a payment was sent and received. Additionally, robust cryptographic methods secure transactions, making them nearly impossible to alter or forge. Combined with the Lightning Network's off-chain processing speed, Bitcoin offers a compelling solution for secure and efficient payments.

What to Consider When Integrating Bitcoin Payments

Bitcoin offers clear benefits in cost efficiency and transaction speed, especially for cross-border payments. However, to fully harness these advantages, businesses need to carefully plan their integration strategies. Key considerations include regulatory compliance, managing Bitcoin's price volatility, ensuring custody and security, and adhering to anti-money laundering (AML) requirements.

Regulatory and Accounting Compliance

Navigating regulatory frameworks is a critical first step. In the U.S., cryptocurrency regulations vary from state to state, creating a complex landscape for businesses operating in multiple jurisdictions. As the PayPal Editorial Staff explains:

"Cryptocurrency regulations are constantly changing. While some cryptocurrency was created to be unregulated and decentralized - without any overseers or intermediaries - governments around the world are considering ways to monitor and manage it".

Beyond licensing, businesses must also account for tax obligations. For instance, converting Bitcoin into fiat currency may trigger capital gains tax, which highlights the need for robust accounting systems to track transactions. Patrick Dike-Ndulue, Editor at Tangem Blog, notes:

"Tax implications - converting crypto to fiat can trigger capital gains tax".

To navigate these challenges, working with financial and tax advisors can help ensure accurate reporting and compliance with IRS guidelines. Once regulatory and tax issues are addressed, the next hurdle is mitigating Bitcoin's price volatility.

Managing Price Volatility

Bitcoin's value can change rapidly, leading to revenue unpredictability. To counter this, many businesses opt for immediate conversion of Bitcoin into fiat currency. Some payment processors now offer automatic conversion at the time of transaction, locking in the exchange rate and providing same-day or next-day fiat settlement. This approach minimizes the financial risk associated with Bitcoin’s price swings.

Custody and Security

Securing Bitcoin funds is another crucial aspect of integration. Managing private keys is essential because losing access to these keys results in permanent loss of funds. Businesses can choose between two main options:

Hardware wallets: These provide direct control over private keys and funds.

Payment processors: These services securely handle custody, often eliminating the need for businesses to manage private keys themselves.

For companies that prefer not to hold Bitcoin, partnering with providers that immediately convert payments into fiat currency can simplify operations and reduce security concerns.

KYC and AML Compliance

Adhering to AML regulations and Know Your Customer (KYC) standards is vital for businesses accepting Bitcoin payments. Monitoring transactions and verifying customer identities are key components of compliance. One established crypto payment service has been setting industry benchmarks since 2011 by maintaining strong KYC, AML, and transaction monitoring practices. An industry expert highlights the risks of neglecting licensing:

"Operating without proper licensing exposes businesses to regulatory risk and limits market access".

In some markets, businesses must navigate multi-layered regulatory oversight. For example, in 2025, a regulated digital asset service provider operated under authorization from both the National Commission of Digital Assets (CNAD) and the Central Reserve Bank, demonstrating the complexity of compliance in certain jurisdictions. Using transaction monitoring tools and collaborating with licensed providers can help businesses maintain compliance across all regions where they operate.

How to Implement Bitcoin and Lightning Infrastructure with Comet Cash

Setting up Bitcoin payment infrastructure with Comet Cash is straightforward, thanks to its ready-to-use platform that supports Bitcoin, Lightning, and Taproot Assets. This end-to-end solution enables global service providers to connect to the Bitcoin Network efficiently, minimizing the need for extensive development work.

Integration Options

Comet Cash provides a variety of tools for seamless integration, including programmable APIs, SDKs, CLI tools, and a web dashboard to manage Bitcoin and Lightning operations. Its non-custodial design ensures businesses maintain full control over their keys and funds. The platform is modular, allowing customization of channel sizes, node configurations, transactions, and assets. Additionally, automated deployment streamlines the setup process, enabling businesses to launch quickly.

How Comet Cash Supports Bitcoin Payment Integration

Comet Cash simplifies Bitcoin payment integration by managing the technical infrastructure while giving businesses operational control. The platform supports real-time Bitcoin payments, stablecoin issuance, and tokenized asset creation. For enhanced security and collaboration, it includes team-based node management, complete with a macaroon bakery for access control. Businesses can also leverage fiat on/off ramps to connect traditional financial systems with crypto operations. With tools like the dashboard and API, users can monitor, test, and refine their setup at any time.

Use Cases for Global Service Providers

Global service providers can incorporate Bitcoin payments into their core operations effortlessly. For instance, treasury teams can take advantage of Bitcoin's borderless nature by holding reserves in Bitcoin, issuing stablecoins to stabilize operations, or tokenizing assets for internal accounting purposes. These features are particularly useful for businesses in regions where conventional banking systems are less accessible.

Scalability and Performance Optimization

Comet Cash is designed to scale with growing payment volumes, offering flexibility through its tiered pricing structure:

Basic: $30/month, includes 300 credits and a single low-tier node for testing purposes.

Pro: $200/month, offers 2,000 credits, up to five nodes (supporting Bitcoin, Lightning, and Taproot), high-tier nodes, and priority support.

Enterprise: $1,000/month, provides 10,000 credits, large-scale deployments, customizable nodes, redundancy and failover options, SLAs, and private networking.

Businesses can adjust Lightning channel sizes and fine-tune node settings to handle increasing transaction volumes, ensuring the infrastructure grows alongside their needs - without requiring a complete system overhaul.

Evaluating Bitcoin Payments for Your Business

Once you've explored how to integrate Bitcoin payments, it's time to decide if they align with your business goals.

Business Profiles That Benefit Most

Certain types of businesses are especially well-suited for Bitcoin payments. SaaS platforms, remote-first companies, and digital agencies often stand to gain the most. These businesses frequently cater to global audiences, deal with recurring cross-border payment challenges, and have teams spread across various countries. Digital service providers - like software development firms, marketing agencies, consulting groups, and subscription platforms - can take advantage of Bitcoin's ability to bypass currency conversion fees and reduce transaction costs to just a few cents.

Additionally, companies targeting younger audiences may find Bitcoin payments particularly appealing. A 2023 Deloitte report revealed that 60% of Millennials and Gen Z view cryptocurrency as a key part of the future financial system. Once you've identified whether your business fits this profile, it's essential to evaluate your operational readiness for Bitcoin adoption with a detailed checklist.

Readiness Checklist

Before diving into Bitcoin payments, ensure compliance with regulations like AML, KYC, OFAC, and tax requirements. In the U.S., cryptocurrency is treated as property for tax purposes, so it's crucial to stay on top of these obligations. Review your treasury policies to decide whether you'll take a hands-off approach - converting Bitcoin to fiat currency immediately through a third party - or a hands-on approach, holding Bitcoin directly on your balance sheet.

You'll also need to confirm that your systems can handle API integrations, node management, and real-time transaction monitoring. Once your infrastructure is in place, establish clear metrics to measure the success of your Bitcoin payment system.

Measuring Success

To evaluate the impact of Bitcoin payments, compare traditional payment fees with Bitcoin's minimal transaction costs of just a few cents. Keep an eye on settlement times (Bitcoin transactions typically confirm in 10–20 minutes), geographic reach, transaction error rates, and customer satisfaction. Bitcoin operates 24/7 with no downtime, which can be a major advantage. Finally, calculate ROI using your preferred method to understand the overall value that Bitcoin payments bring to your business operations.

Conclusion

Global service providers can tackle cross-border payment hurdles by incorporating Bitcoin into their operations. Its lower transaction fees, quicker settlement times, and round-the-clock availability address many of the inefficiencies found in traditional payment systems. By eliminating unnecessary fees and delays, Bitcoin empowers businesses to function more effectively, especially when entering emerging markets where conventional banking infrastructure often falls short. With advanced solutions like the Bitcoin and Lightning Network, businesses can finally overcome these longstanding payment challenges.

This is where Comet Cash steps in as a game-changer for Bitcoin payment integration. If you're looking for a simple way to tap into Bitcoin's benefits, Comet Cash offers real-time, non-custodial integration through user-friendly APIs and dashboards. Whether you're running a SaaS platform, digital agency, or fintech service, Comet Cash makes it easy to integrate Bitcoin payments without the need for building complex systems. With support for the Lightning Network and customizable node settings, it’s a seamless solution tailored to your needs.

To adopt Bitcoin payments successfully, businesses must align the process with their unique profiles, ensure compliance with regulations, and address volatility - either through instant fiat conversion or strategic cryptocurrency holdings. With the right strategy, global service providers can maximize Bitcoin's potential while minimizing associated risks.

As the Bitcoin payment ecosystem continues to expand, those who act early stand to gain the most. By integrating Bitcoin payments into your operations today, you position your business to thrive in a financial system built for the digital age and unlock opportunities for future growth.

FAQs

How can businesses handle Bitcoin's price volatility when accepting it as payment?

To address Bitcoin's price swings, businesses can rely on services that instantly convert Bitcoin payments into fiat currency, like the U.S. dollar, as soon as the payment is received. This approach reduces the risk of price changes and ensures a steady cash flow.

Another option is partnering with payment processors or platforms that include tools to manage volatility. These tools make transactions smooth and secure, simplifying operations while still allowing businesses to enjoy the advantages of accepting Bitcoin payments.

What regulatory challenges should businesses consider when adopting Bitcoin payments?

When incorporating Bitcoin payments, businesses often encounter regulatory hurdles. These can include varying laws across countries, shifting compliance standards, and tax obligations, such as reporting cryptocurrency as property. Additionally, addressing concerns about potential misuse and ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations are crucial.

To tackle these issues, businesses should keep up-to-date with both local and international regulations, consult legal professionals, and establish strong compliance protocols. Taking these proactive steps can help reduce risks and make integrating Bitcoin payments into daily operations much smoother.

How does Bitcoin make financial services more accessible in areas with limited banking options?

Bitcoin opens up financial opportunities in areas where banking systems are limited or even nonexistent. By enabling borderless, peer-to-peer transactions, it removes the need for traditional banks. This approach cuts down on costs and sidesteps obstacles like hefty fees or strict account requirements, making it possible for unbanked individuals to engage in the global economy.

Thanks to decentralized networks and mobile-friendly wallets, anyone with a smartphone and internet access can send or receive payments securely. This simple setup provides people in underserved regions with access to financial tools and services that were once out of reach, helping to expand economic participation and opportunity.